|

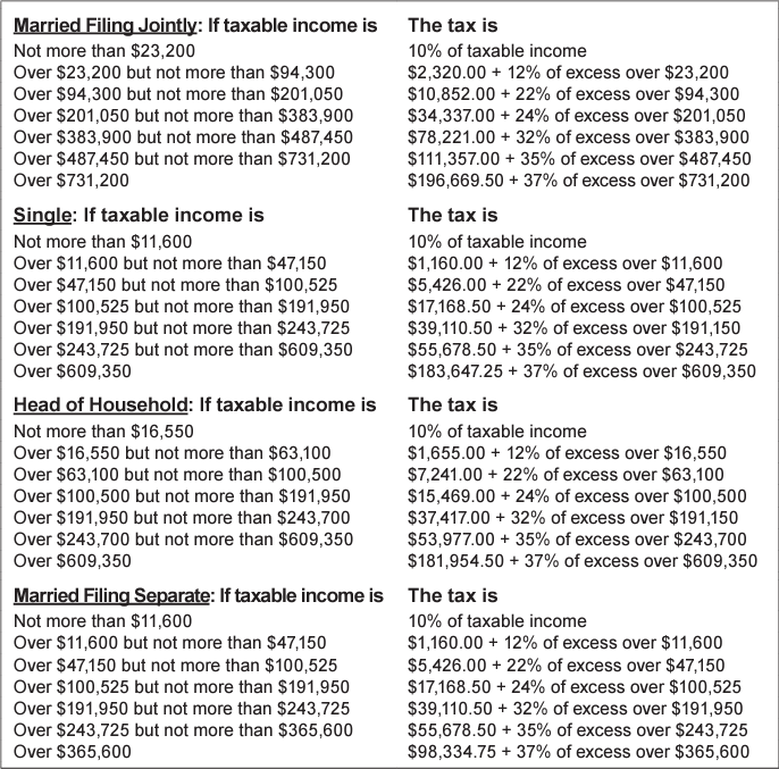

There are lots of tax changes for 2024. Some reflect prior-year inflation. Others are new rules. But one thing is certain…all taxpayers are affected. Start with key provisions in SECURE 2.0… the 2022 law to bolster retirement savings. It has over 90 provisions with different effective dates. Among the changes that take effect this year: More penalty-free early withdrawals by people under age 59½ from IRAs and 401(k)s. Up to $10,000 for domestic abuse victims and $1,000 for emergencies can be taken without paying the 10% additional tax. Funds in 529 education accounts can be rolled over tax-free to a Roth IRA. There is a $35,000 lifetime cap. Rollover amounts can’t exceed the annual payin limit for Roth IRAs. And the 529 account must have been open for more than 15 years. Roth 401(k) owners no longer need to take required minimum distributions. Plan sponsors can create emergency savings accounts for participants, who could then make Roth payins (on an after-tax basis) to that savings account within the plan. A participant’s account balance can’t exceed $2,500. The qualified charitable distribution cap is indexed for inflation, so that IRA owners 70½ and older can transfer up to $105,000 in 2024 from their IRAs directly to charity without having to pay tax on the withdrawal. Plus these: The employer contribution limits for SIMPLEs increase. Employers with no existing retirement plans can offer starter 401(k) accounts with default automatic enrollment (with a payin cap the same as that for IRAs). Additionally, student loan relief can be offered through workplace retirement plans. Key dollar limits on workplace retirement plans and IRAs increase for 2024. The maximum 401(k) contribution is $23,000. People born before 1975 can contribute an extra $7,500. These limits also apply to 403(b)s and 457 plans. SIMPLEs have a $16,000 cap, plus $3,500 for individuals age 50 and older. The 2024 contribution cap for traditional IRAs and Roth IRAs is $7,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and older. The income ceilings on Roth IRA payins are higher. Contributions phase out at AGIs of $230,000 to $240,000 for couples and $146,000 to $161,000 for singles. 2024 deduction phaseouts for traditional IRAs range from AGIs of $123,000 to $143,000 for couples covered by 401(k)s and $77,000 to $87,000 for singles and household heads. If only one spouse is covered by the plan, the phaseout range for deducting payins for the uncovered spouse is $230,000 to $240,000. The Social Security annual wage base for 2024 is $168,600, an $8,400 hike. The Social Security tax rate on employers and employees remains 6.2%. Both pay the 1.45% Medicare tax on all compensation, with no cap. Individuals also pay an additional 0.9% Medicare surtax on wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn’t hit employers. The nanny tax threshold is $2,700 for 2024, a $100 increase from 2023. The income tax brackets for individuals are much wider for 2024 because of inflation during the 2023 fiscal year. Tax rates are unchanged. Standard deductions are higher for 2024. Married couples get $29,200, plus $1,550 for each spouse 65 or older. Singles can claim $14,600…$16,550 if age 65 or up. Heads of household get $21,900 plus $1,950 once they reach 65. Blind people receive $1,550 more ($1,950 if unmarried and not a surviving spouse). Tax rates on long-term capital gains and qualified dividends do not change. But the income thresholds to qualify for the various rates go up for 2024. The 0% rate applies at taxable incomes up to $94,050 for joint filers, $63,000 for household heads and $47,025 for singles. The 20% rate starts at $583,751 for joint filers, $551,351 for household heads and $518,901 for single filers. The 15% rate is for filers with taxable incomes between the 0% and 20% break points. AMT exemptions rise for 2024 to $133,300 for couples and $85,700 for singles and household heads. The exemption phaseout zones start at $1,218,700 for couples and $609,350 for others. The 28% AMT rate kicks in above $232,600. The kiddie tax has less bite in 2024. The first $1,300 of unearned income of a child under age 19…under age 24 if a full-time student…is tax-free. The next $1,300 is taxed at the child’s rate. Any excess is taxed at the parent’s rate. Eligible buyers of qualifying EVs can opt to monetize the up to $7,500 credit, starting in 2024, by transferring it to the dealer at the time of purchase, thus lowering the amount the buyer pays for the car. Buyers can otherwise elect to claim the break on their federal tax return that they will file in the subsequent year. Guidance from the Service requires auto dealers to register on IRS’s online tool, IRS Energy Credits Online, to receive advance credit payments from eligible EV sales. Buyers who opt for the advance credit to lower the cost of the car will have to repay it when filing their 1040 if their modified AGI exceeds the limit for taking the credit. The adoption credit is taken on up to $16,810 of qualified expenses in 2024. The full credit is available for a special-needs adoption even if it costs less. The credit phases out for filers with modified AGIs over $252,150 and ends at $292,150. The annual cap on deductible contributions to HSAs rises in 2024 to $4,150 for account owners with self-only coverage and $8,300 for those with family coverage. People born before 1970 can put in an extra $1,000. Eligibility for HSAs is restricted. You must have a high-deductible health plan. The minimum policy deductible for 2024 is $1,600 for self-only coverage and $3,200 for family coverage. Additionally, out-of-pocket costs, including copayments, can’t exceed $8,050 for individual coverage and $16,100 for family coverage in 2024. Here are the limits on deducting long-term-care premiums for 2024. Taxpayers who are age 71 or older can write off as much as $5,880 per person. Filers age 61 to 70…$4,710. Those who are 51 to 60 can deduct up to $1,760. Individuals who are 41 to 50 can take $880. And people age 40 and younger…$470. For most, long-term-care premiums are medical expenses deductible only by itemizers on Schedule A and only to the extent that total medicals exceed 7.5% of AGI. Self-employed individuals can deduct the premiums on Schedule 1 of the 1040. Employees covered by health flexible savings accounts can defer up to $3,200. The cap on tax-free employer-provided parking for 2024 is $315 a month. The exclusion for mass transit passes and commuter vans matches that amount. U.S. taxpayers working abroad have a $126,500 income exclusion for 2024. The Revenue Service delays the lower dollar threshold for 1099-K reporting. A 2021 law requires third-party settlement networks, such as PayPal, Venmo and Square, to send 1099-Ks to payees who are paid more than $600 a year for goods and services. It was scheduled to begin with 2022 1099-K forms sent out in 2023. The rule got lots of slack, so IRS has now postponed it for the second year in a row. 2023 Forms 1099-K sent out this year will be covered by the old rules. Forms will be sent to payees with over 200 transactions, who were paid over $20,000. 2024 Forms 1099-K sent out in 2025 will have a $5,000 reporting threshold. If filing 10 or more information returns, they must be electronically filed. The previous 250-return threshold for e-filing has been drastically lowered, beginning with 2023 information returns filed this year. The e-filing requirement applies to 1099s, W-2s, 1098s and many other forms. All information returns are combined for purposes of meeting the 10-return threshold for e-filing. IRS has an online portal to e-file Forms 1099. Information Returns Intake System or IRIS is free for businesses of any size, but you’ll need an ID.me account to use it. Filers who can’t comply can use Form 8508 to apply for a hardship waiver. The lifetime estate and gift tax exemption for 2024 is $13,610,000… More estate tax liability qualifies for an installment payment tax break. If one or more closely held businesses make up greater than 35% of a 2024 estate, as much as $740,000 of tax can be deferred, and IRS will charge only 2% interest. The annual gift tax exclusion is $18,000 per donee. You can gift up to $18,000 ($36,000 if your spouse agrees) to each child, grandchild or any other person in 2024 without having to file a gift tax return or tap your lifetime estate and gift tax exemption. First-year bonus depreciation isn’t as valuable in 2024. Last year, businesses could deduct 80% of the cost of new and used qualifying business assets with lives of 20 years or less. This year, the 80% write-off decreases to 60%. But expensing is higher. $1,220,000 of assets can be expensed in 2024. This limit phases out dollar for dollar once more than $3,050,000 of assets are put into use in 2024. Note that the amount of business assets expensed can’t exceed the business’s taxable income. Bonus depreciation doesn’t have this rule. A key dollar threshold on the 20% deduction for pass-through income rises in 2024. Self-employeds and owners of LLCs, S corporations and other pass-throughs can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes of more than $383,900 for joint filers and $191,950 for all others. More companies can use the cash method of accounting. For taxable years beginning in 2024, C corporations with average annual gross receipts of $30 million or less over the previous three years can use the cash method. This threshold also applies to partnerships and LLCs that have C corporations as owners. The 2024 standard mileage rate for business driving is 67 cents per mile. The mileage allowance for medical travel and military moves is 21 cents per mile in 2024. The charitable driving rate is fixed by law and stays put at 14 cents a mile. Certain clean-energy credits in the Inflation Reduction Act can be monetized. Businesses may elect to transfer 11 of the credits to unrelated third parties for cash. State and local government and their instrumentalities and tax-exempt organizations can elect to treat 12 of the energy-savings credits as a payment of federal income tax and receive an income tax refund for the amount that exceeds any taxes they owe. A new beneficial ownership reporting regime for small firms begins in 2024. It’s run by the Financial Crimes Enforcement Network. Certain corporations, LLCs and other entities must report information about themselves and their beneficial owners to FinCEN. There are lots of exceptions to reporting, including one for operating firms with over 20 full-timers, over $5 million in gross receipts, and a U.S. physical office. Entities in existence before 2024 have until Dec. 31, 2024, to file their report. Entities formed after 2023 have 90 days after the date of formation to comply. Reporting will be done electronically through FinCEN’s website. Although this isn’t a tax rule, businesses and tax professionals should be aware of it. Credit to THE KIPLINGER TAX LETTER

0 Comments

It’s time to review your year-end tax plans. With two months left before 2023 comes to a close, this blog focuses on actions you can take to cut your federal tax bill. We’ll delve into individual planning, investments, gifts, business taxes and much more.

On individual tax planning, look at the overall impact on 2023 and 2024. The goal is to lower your taxes over both years. Most benefit by accelerating write-offs from 2024 into 2023 while deferring taxable income. Others take the opposite approach. Itemizers have the most flexibility in shifting write-offs, as shown here. Home interest. If you pay your Jan. 2024 mortgage bill before year-end, you can deduct the interest portion on Schedule A of your 2023 federal tax return. State and local taxes. If under the $10,000 cap and your locale allows it, pay the property tax bill due in Jan. 2024 in Dec. of this year so you can deduct it. Bunch into 2023 charitable gifts you would usually give over multiple years. And think about incurring additional medical expenses before year-end if your medicals are near or have topped the 7.5%-of-adjusted-gross-income threshold. Check out IRS Pub. 502. The list of eligible medicals is broader than you may think. Heed the timing rules for charitable donations and other tax-deductible items. Put checks in the mail by year-end to lock in a 2023 deduction. For charges made with bank credit cards, you can claim the write-off in the year you charged the expense. If pondering home upgrades…go green to claim one of two tax credits: The residential clean-energy property credit is equal to 30% of the cost of solar panels, solar-powered water heaters, geothermal heat pumps and more. The smaller energy-efficient home improvement credit applies to insulation, boilers, central air-conditioning systems, water heaters, heat pumps, exterior doors, windows and the like that meet certain energy efficiency ratings. This credit for 30% of the cost of these eco-savings upgrades used to have a $500 lifetime limitation, but no more. There is now a general $1,200 aggregate yearly credit limit, but some specific upgrades have lower monetary caps, while others have larger ones. If planning for multiple upgrades, think about staggering them over 2023 and 2024. Don’t forget about the tax credit for buying an electric vehicle. Many new EVs qualify for a credit of up to $7,500. The break is up to $4,000 if buying a used EV. Some high-cost EVs aren’t eligible. The manufacturer’s suggested retail price can’t exceed $55,000 for sedans and $80,000 for vans, SUVs and pickup trucks. There’s an income limit. Modified adjusted gross income can’t exceed $300,000 for couples, $225,000 for household heads or $150,000 for singles. For used-EV buyers, the modified AGI thresholds are $150,000, $112,500 and $75,000, respectively. If you wait until 2024 to buy an EV, you can opt to monetize the credit by transferring it to the dealer at the time of purchase, thus lowering the amount you will pay for the car. This allows you to take immediate advantage of the credit. Consider a short-term rental of your home and pocket tax-free cash. The proceeds from a personal residence that is rented out 14 days or less in a year are nontaxable and aren’t reported on your return, no matter the rent charged. Make the most of your generosity when donating to charitable organizations. Contribute appreciated property, such as stocks or shares in mutual funds. If you’ve owned the property for more than a year, you can deduct its full value in most cases if you itemize. Neither you nor the charity pays tax on the appreciation. Don’t donate assets that have dropped in value. If you do, the loss is wasted. Use your annual gift tax exclusion. You can give each person up to $17,000… $34,000 if you are married…this year without paying gift tax, filing a gift tax return or tapping your lifetime estate and gift tax exemption. Recipients aren’t taxed on gifts. Gifts over the exclusion amount will trigger the filing of a gift tax return for 2023. But you won’t owe federal gift tax unless your lifetime gifts exceed $12,920,000. Here are two ways to help your kids or grandkids with their college education: Pay tuition directly to the school. The payment is nontaxable to the student, it doesn’t count against the $17,000 gift tax exclusion, and it reduces your estate. Contribute to a 529 plan. You can shelter from gift tax up to $85,000 in contributions per beneficiary this year ($170,000 if your spouse agrees). If you put in the maximum, you’ll be treated as gifting $17,000 (or $34,000) to that beneficiary in 2023 and in each of the next four years…2024 through 2027. Pay attention to the required minimum distribution rules for traditional IRAs. People 73 and older must take annual payouts. To arrive at the 2023 RMD, start with your IRA balances as of Dec. 31, 2022, and use the tables in IRS Pub. 590-B. If 2023 is your first RMD year, you have until April 1, 2024, to take the RMD, though the amount is still based on your total IRA balance as of Dec. 31, 2022. Similar rules apply to 401(k)s. However, people who work past age 73 can generally delay taking RMDs from their current employer’s 401(k) until they retire. Charitable donations made directly from a traditional IRA can save taxes. People 70½ and older can transfer up to $100,000 yearly from IRAs directly to charity. Qualified charitable distributions can count as RMDs, but they’re not taxable and they’re not added to your AGI. The QCD strategy is a good way to get tax savings from charitable gifts for taxpayers not itemizing because of higher standard deductions. The money must generally go to a 501(c)(3) charitable organization… But the SECURE 2.0 law provides an easing to this rule. IRA owners can do a one-time (not annual) qualified charitable distribution of up to $50,000 through a charitable remainder annuity trust, charitable remainder unitrust or a charitable gift annuity. Many private colleges with charitable gift annuity programs are now touting this QCD option, so you may hear about it from your alma mater. Max out your 2023 401(k) and IRA contributions. You have until Dec. 31 to put money in 401(k)s and other workplace retirement plans, and until April 15, 2024, to contribute to an IRA for 2023. You can stash up to $22,500 in a 401(k)…$30,000 if age 50 or up. The 2023 payin cap for IRAs is $6,500, plus $1,000 more if 50 or older. Consider whether it’s the right time to convert a traditional IRA to a Roth IRA. You’ll have to pay tax on the converted amount, but future earnings are tax-free. Among the factors to consider in making your decision: Income tax rates for 2023 and later years. If you expect the rate you will pay in retirement to be the same or higher than the rate on the conversion, then switching to a Roth can pay off taxwise. Roths don’t have required minimum distributions, unlike traditional IRAs. Whether your account value is depressed and/or whether you think it will rise. And income from the conversion will increase your adjusted gross income, thus potentially triggering higher Medicare premiums two years down the line. Note you don’t need to convert the entire amount to a Roth in one swoop. Your investment portfolio provides plenty of tax-saving opportunities. See if you qualify for the 0% rate on long-term gains and qualified dividends. If taxable income other than long-term gains or dividends doesn’t exceed $44,625 on single returns, $59,750 for head-of-household filers or $89,250 on joint returns, then your qualified dividends and profits on sales of assets owned more than a year are taxed at a 0% federal rate until they push you over the threshold amounts. The 0% federal rate isn’t all gravy. Zero-percent-rate gains and dividends might not be taxed at the federal level, but they do hike adjusted gross income. The extra AGI can cause more of your Social Security benefits to be taxed. Also, your state income tax bill may jump, since many states tax gains as ordinary income. If you’re not eligible for the 0% rate, there is always the 15% or 20% rate. The 20% rate on long-term capital gains and qualified dividends starts at $492,301 for singles, $523,051 for heads of household and $553,851 for couples filing jointly. The 15% rate is for filers with incomes between the 0% and 20% break points. Take steps to limit the sting of the 3.8% surtax on net investment income… dividends, taxable interest, capital gains, passive rents, annuities, royalties, and income from a passive activity if the taxpayer doesn’t materially participate. The tax applies to single filers with modified adjusted gross incomes above $200,000 and joint filers over $250,000. Modified AGI is AGI plus tax-free foreign earned income. The tax is due on the smaller of NII or the excess of modified AGI over the thresholds. Buying municipal bonds is helpful, since tax-free interest is exempt from the 3.8% bite. Know the rules on capital losses if you have some duds you want to sell. Capital losses offset capital gains plus up to $3,000 of other income. Excess losses are then carried over to the next year and can help offset future capital gains. If you have capital loss carryforwards, cull your portfolio for capital gains. That’s because your net gains…up to the carryover amount…won’t be taxed at all. Tax loss harvesting is one way that investors can lower their tax bill. The strategy involves selling stocks or other holdings in your taxable accounts that have declined in value for the purpose of generating capital losses to offset gains from the sale of winners. Investors commonly do this closer to the end of the year, when they have a better idea of the amount of total capital gains they will have. Beware of the sneaky wash-sale rule. It prohibits a capital loss write-off on the sale of securities if you purchase substantially identical securities up to 30 days before or after the sale. The recognized loss isn’t gone forever…it’s only suspended. That’s because the loss is added to the tax basis of your replacement securities. The wash-sale rule can catch you by surprise. It applies between spouses. You have a wash sale if you sell securities at a loss and your spouse, or a corporation that you control, buys substantially identical securities within the 60-day period. Ditto if you have your IRA purchase stock after you sell the same stock at a loss in your taxable investment account, or if you happen to sell mutual fund shares at a loss less than 30 days after the date a dividend is reinvested to buy more shares. People who sell crypto at a loss needn’t worry about the wash-sale rule. The definition of securities for purposes of the wash-sale rule doesn’t include crypto. So, for example, if you own crypto that sharply falls in value, you can sell it, recognize a capital loss, and buy the same digital currency the same day or soon after. Think about investing in REITs or publicly traded partnerships. You could get a nice tax break. The 20% deduction for pass-through income also applies to holders of interests in real estate investment trusts and PTPs. Individuals can deduct on their federal return 20% of their qualified REIT dividends… distributions that aren’t otherwise taxed under the favorable rules for capital gains and dividends…and 20% of their allocable share of a PTP’s qualified income. Boost your federal income tax withholding if you expect to owe tax for 2023. It can help avoid an underpayment penalty. You’re off the hook for the fine if you prepay, via tax payments or withholding, at least 90% of your 2023 total tax bill or 100% of what you owed for 2022 (110% if your 2022 AGI exceeded $150,000). You can give your employer a new W-4 to have more tax taken from wages. Fill out W-4V to have federal tax withheld from your Social Security benefits. You can elect to have 7%, 10%, 12% or 22% of your monthly benefits taken out. IRA owners taking RMDs can use this income tax withholding strategy: Have more tax withheld from a year-end distribution from your traditional IRA. Tax withheld at any point in the year is treated as if evenly paid throughout the year. By default, IRA custodians withhold 10%, but you can ask for more to be withheld. Don’t forget about the 0.9% Medicare surtax on earned income. It kicks in for joint filers with earnings over $250,000…$200,000 for singles and household heads. Employers must begin to withhold the tax from worker paychecks in the period when wages first exceed $200,000, regardless of the employee’s marital status. This can lead to underwithholding for a couple if each spouse earns under $200,000, but their combined wages total more than $250,000. The same goes for an employee with a self-employed spouse if the couple’s combined earnings will exceed $250,000. There are generous write-offs for business asset purchases this year. Businesses can save lots on taxes with first-year 80% bonus depreciation. Firms can deduct 80% of the cost of new and used qualifying business assets, with lives of 20 years or less, that they buy and place in service by Dec. 31, 2023. Purchase and place assets in service this year if you want the 80% break. It falls to 60% next year, 40% in 2025, 20% in 2026 and ends after 2026. Expensing is available. In 2023, businesses can expense up to $1,160,000 of new or used business assets. This limit phases out once more than $2,890,000 of assets are put into service during 2023. Note that the amount expensed can’t exceed the business’s taxable income. Bonus depreciation doesn’t have this rule. There are lots of breaks for buyers of business vehicles under the tax laws. For new and used cars first put in use in 2023, if bonus depreciation is taken, the first-year cap is $20,200. The second- and third-year caps are $19,500 and $11,700. After that…$6,960. If no bonus depreciation is claimed, the first-year cap is $12,200. Buyers of heavy SUVs also get write-offs. Up to $28,900 of the cost of SUVs with vehicle weights over 6,000 pounds can be expensed in 2023. 80% of the balance gets bonus depreciation, and the rest may qualify for regular five-year depreciation. Up to 100% of the cost of a big truck used in business can be expensed, subject to the rule that total expensing can’t exceed taxable income from the business. See if you can take advantage of the 20% deduction for pass-through income. The self-employed and owners of LLCs, S corporations and other pass-through entities can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes of more than $364,200 for joint filers and $182,100 for all others. If you’re close to or just above the income limits, consider accelerating deductions or deferring income so that you can come in under the dollar thresholds for the year. Gig workers who aren’t employees can claim this write-off from their earnings. Schedule E rental income may be eligible for the deduction in some cases. Credit to THE KIPLINGER TAX LETTER With only one month left to go in 2022… It’s time to review your year-end tax plans. Knowing the federal tax breaks to take advantage of and the pitfalls to avoid can save you money.

Let’s start with individual tax planning. Look at the overall impact on 2022 and 2023. The end game is to reduce your taxes over both years. Most will benefit by accelerating write-offs from 2023 into 2022 while deferring taxable income. Others may profit by taking the opposite approach. Itemizers have the most flexibility in shifting write-offs, as shown here. Home interest. If you pay your Jan. 2023 mortgage bill before year-end, you can deduct the interest portion on Schedule A of your 2022 income tax return. State and local taxes. If under the $10,000 cap and your locale allows it, pay the property tax bill due in Jan. 2023 in Dec. of this year so you can deduct it. Bunch into 2022 charitable gifts you would usually give over multiple years. And think about incurring additional medical expenses before year-end if your medicals are near or have topped the 7.5%-of-adjusted-gross-income threshold. The list of eligible medicals is broad. It includes out-of-pocket payments to doctors, dentists, optometrists and other medical professionals; mental health services; health insurance and Medicare premiums; prescription drugs; glasses and hearing aids. Also, the unreimbursed cost of long-term care and certain home improvements to accommodate a disability or physical illness, such as a ramp and wide doorways. Heed the timing rules for charitable donations and other tax-deductible items. Put checks in the mail by year-end to lock in a 2022 deduction. For charges made with bank credit cards, you can claim the write-off in the year you charged the expense. Use your annual gift tax exclusion. You can give up to $16,000 to each person this year without having to tap your lifetime estate and gift tax exemption, pay gift tax or file a gift tax return. The recipient isn’t taxed on the amount received, either. Any unused amount is gone forever. You can’t give extra next year to make up for it. Your spouse can also give $16,000. Say you’re married with two kids and one grandkid. You can give each relative up to $32,000 ($96,000 total) this year in excludable gifts. Annual gifts over the exclusion amount will trigger filing of a gift tax return for 2022, but no federal gift tax will be due unless your total lifetime gifts exceed $12,060,000. Here are two ways to help your kids or grandkids with their college education: Pay tuition directly to the school. The payment is nontaxable to the student, it doesn’t count against the $16,000 gift tax exclusion, and it reduces your estate. Contribute to a 529 plan. You can shelter from gift tax up to $80,000 in contributions per beneficiary this year ($160,000 if your spouse agrees). If you put in the maximum, you’ll be treated as gifting $16,000 (or $32,000) to that beneficiary in 2022 and in each of the next four years…2023 through 2026. With the stock market’s bumpy year so far…review your investment portfolio. Think about selling some duds to offset any gains from the rare winners. Capital losses offset capital gains plus up to $3,000 of other income. Excess losses are then carried over to the next year and can help offset future capital gains. But don’t run afoul of the wash-sale rule, which bars a capital loss write-off if you purchase substantially identical securities up to 30 days before or after a sale. Any disallowed loss is added to the tax basis of the replacement securities. The wash-sale rule can catch you by surprise. For example, if you buy stock in an IRA after selling the same stock at a loss in your taxable investment account, or if you sell a mutual fund at a loss shortly after the date a dividend is reinvested. If you have capital loss carryforwards, cull your portfolio for capital gains. That’s because your net gains…up to the carryover amount…won’t be taxed at all. See if you qualify for the 0% rate on long-term gains and qualified dividends. If taxable income other than long-term gains or dividends does not exceed $41,675 on single returns…$55,800 for head-of-household filers or $83,350 on joint returns… then your qualified dividends and profits on sales of assets owned more than a year are taxed at a 0% federal rate until they push you over the threshold amounts. Here are three scenarios to illustrate the rules. In the following examples, you have a married couple with $12,000 of qualified dividends and long-term gains, which are included in taxable income. In the first example, the couple has $70,000 of taxable income. The full $12,000 of gains and dividends is taxed at the 0% rate. Let’s now assume the couple has taxable income of $90,000. $5,350 of the gains and dividends ($83,350 - ($90,000 - $12,000)) gets the favorable 0% tax rate, and $6,650 is taxed at 15%. If the couple instead has $115,000 of taxable income, the 0% rate doesn’t apply and the full $12,000 of gains and dividends is taxed at 15%. The 0% federal rate isn’t all gravy. Zero-percent-rate gains and dividends might not be taxed at the federal level, but they do hike adjusted gross income. The extra AGI can cause more of your Social Security benefits to be taxed. Also, your state income tax bill may jump, since many states tax gains as ordinary income. Take steps to limit the pesky 3.8% surtax on net investment income. The tax applies to single filers with modified adjusted gross incomes above $200,000 and joint filers over $250,000. Modified AGI is AGI plus tax-free foreign earned income. The tax is due on the smaller of NII or the excess of modified AGI over the thresholds. Included in net investment income: Dividends, taxable interest, capital gains, passive rents, annuities and royalties. Income from a passive activity is also NII if the taxpayer doesn’t materially participate, even if the income is from a business. Buying municipal bonds can help keep the surtax at bay. Tax-free interest is not only exempt from the 3.8% bite, but it also doesn’t affect the owner’s AGI. Be wary of buying a mutual fund late in the year for your taxable portfolio. If you are thinking about investing in a dividend-paying mutual fund near year-end, check its dividend distribution schedule. Buying a fund shortly before the record date this year means you will get the dividend payout for 2022, which you will owe tax on when you file your return next year. You aren’t better off financially, however, because the fund’s share price falls by the amount of the distributed dividend. To avoid this, think about buying the mutual fund after the dividend record date. Check your health flexible spending account. You must clean it out by Dec. 31 if your employer hasn’t implemented the 2½-month grace period or $570 carryover rule. Otherwise, you will forfeit any money left in your account. Also, consider electing to contribute to a health FSA for 2023. You can put in up to $3,050 next year to your employer’s health FSA to cover out-of-pocket medicals. Amounts contributed to an FSA escape federal income tax as well as payroll taxes. Max out your 2022 401(k) and IRA contributions. You have until Dec. 31 to stash money in 401(k)s, 403(b)s and other workplace retirement plans, and until April 18, 2023, to contribute to a traditional IRA or a Roth IRA for 2022. Individuals can contribute up to $20,500 to a 401(k), plus $6,500 more if age 50 or up. The 2022 payin cap for IRAs is $6,000, plus an extra $1,000 if age 50 and older. Now might be a good time to convert a traditional IRA to a Roth IRA, given the ailing stock market. You will have to pay tax on the converted amount, but once the money is in the Roth, future earnings are tax-free. Key to any decision are present and future tax rates. If you expect that your tax rate in retirement will be the same as or higher than the rate on the conversion, switching to a Roth can pay off taxwise, provided you don’t have to tap IRA funds to pay the tax bill on the conversion. If your tax rate in retirement will be lower, then tax-free payouts could be less advantageous. You needn’t convert your entire account balance at once. You can transfer the money in increments over time, and space out the tax hit. Heed the required minimum distribution rules for traditional IRAs. Individuals 72 and older must take annual withdrawals or pay a 50% penalty. To arrive at the 2022 RMD amount, start with your IRA balances as of Dec. 31, 2021, and use the tables in IRS Pub. 590-B. The amounts can be taken from any IRA you pick. If 2022 is your first RMD year, you have until April 3, 2023, to take the RMD. The distribution will still be based on your total IRA balance as of Dec. 31, 2021. If you opt to defer your first RMD to 2023, you will be taxed in 2023 on two payouts: The deferred one for 2022 and the RMD for 2023. This will hike your 2023 income. Similar rules apply to 401(k)s, with two exceptions. People who work past 72 can generally delay taking RMDs from their current employer’s 401(k) until they retire. Additionally, if you have multiple 401(k)s, an RMD must be taken from each account. Charitable donations made directly from a traditional IRA can save taxes. People 70½ and older can transfer up to $100,000 yearly from IRAs directly to charity. Qualified charitable distributions can count as RMDs, but they’re not taxable and they’re not added to your AGI, so they won’t trigger a Medicare premium surcharge in 2024. The QCD strategy can be a good way to get tax savings from charitable gifts for taxpayers not taking charitable write-offs because of higher standard deductions. Be sure to get a receipt from the charity to substantiate the donation. Make the most of your generosity when donating to charitable organizations. Contribute appreciated property, such as stocks or shares in mutual funds. If you’ve owned the property for more than a year, you can deduct its full value in most cases if you itemize. Neither you nor the charity pays tax on the appreciation. Don’t donate assets that have dropped in value. If you do, the loss is wasted. Boost your federal income tax withholding if you expect to owe tax for 2022. It can help avoid an underpayment penalty. You’re off the hook for the fine if you prepay, via tax payments or withholding, at least 90% of your 2022 total tax bill or 100% of what you owed for 2021 (110% if your 2021 AGI exceeded $150,000). The Revenue Service has a helpful withholding tax estimator tool on its website. You can give your employer a new W-4 to have more tax taken from wages. IRA owners taking RMDs can use this income tax withholding strategy: Have more tax withheld from a year-end distribution from your traditional IRA. Tax withheld at any point in the year is treated as if evenly paid throughout the year. Don’t forget about the 0.9% Medicare surtax on earned income. It kicks in for joint filers with earnings over $250,000…$200,000 for singles and household heads. Employers must begin to withhold the tax from worker paychecks in the period when wages first exceed $200,000, regardless of the employee’s marital status. There are very generous write-offs for business asset purchases this year. Businesses can save lots on taxes with first-year 100% bonus depreciation. Firms can deduct the full cost of new and used qualifying business assets, with lives of 20 years or less, that they buy and place in service by Dec. 31. The cost of a qualified film, television or theatrical production is eligible, too. Purchase and place assets in service this year if you want the full break. Bonus depreciation isn’t as valuable after 2022. Unless Congress acts, the 100% write-off phases out 20% for each year after 2022. So for 2023, it’s 80%. Expensing is also available. Businesses can expense up to $1,080,000 of new or used business assets. This limit phases out once more than $2,700,000 of assets are put into service during 2022. Note that the amount expensed can’t exceed the business’s taxable income. Bonus depreciation doesn’t have this rule. There are lots of breaks for buyers of business vehicles under the tax laws. If bonus depreciation is claimed, the first-year ceiling is $19,200 for new and used cars first put in service this year. The second- and third-year caps are $18,000 and $10,800. After that…$6,460. If no bonus depreciation is taken, the first-year cap is $11,200. Buyers of heavy SUVs used solely for business can write off the full cost, thanks to bonus depreciation. SUVs must have a gross weight rating over 6,000 pounds. With 80% bonus depreciation in 2023, the above breaks won’t be as valuable. Up to 100% of the cost of a big truck used in business can be expensed, subject to the rule that total expensing can’t exceed taxable income from the business. Don’t forget about the 20% deduction you can take on pass-through income. The self-employed and owners of LLCs, S corporations and other pass-through entities can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes of more than $340,100 for joint filers and $170,050 for all others. If you’re close to or just above the income limits, consider accelerating deductions or deferring income so that you can come in under the dollar thresholds for the year. Gig workers who aren’t employees can claim this write-off from their earnings. Also, Schedule E rental income may be eligible for the deduction. But applying the QBI rules to income from rentals of real property is thorny. IRS regs say the rental activity must generally rise to the level of a trade or business, a standard which is based on each taxpayer’s particular facts and circumstances. Alternatively, there is a safe harbor if at least 250 hours a year of qualifying time are devoted to the activity by the taxpayer, employees or independent contractors. Shareholders in C corps should weigh taking dividends in lieu of salary if the owner is in a high tax bracket. The owner’s preferential tax rate on dividends plus the corporation’s payroll tax savings from paying dividends instead of salaries can exceed the firm’s forgone tax benefit from not being able to deduct the dividend. This doesn’t work for S corporations, since their income passes through to owners. Business owners can shift income and expenses between 2022 and 2023. Professionals can postpone their year-end billings to collect less revenue in 2022. Or they can speed them up if they expect to be in a higher tax bracket next year. Firms can juggle their income by shifting some expenses from one year to another. It’s easier for cash-method firms to shift income and expenses between years than for taxpayers who adopt the more complicated accrual method of accounting. Credit to THE KIPLINGER TAX LETTER What is a Form 1099-NEC?

Form 1099-NEC is essentially an information report that is required to be sent to certain recipients who have been paid during the year in the course of a trade or business. A copy of the Form 1099-NEC is also reported to the Internal Revenue Service (and some states) for their records as well. Failure to file a required 1099-NEC may result in denied expense deductions upon audit and additional penalties and fees (typically $30 to $100 per missed filing for federal purposes). Form 1099-NEC Filing Requirements Form 1099-NEC must be filed when Non-employee Compensation of $600 or more is paid during the year to a non-employee. Includes payment for professional services (fees to attorneys, accountants, engineers, repairman, etc.). 1099-NEC Filing Exemptions There are a few cases when Form 1099-MISC does not need to be filed even though it may have met the aforementioned requirements. A few examples are as follows:

Tax Reporting of 1099-NEC There is now a question on tax returns which specifically ask if a business was required to issue 1099s and if so, whether they were filed. Therefore, the IRS has implemented extra measures to make sure the 1099-NECs are filed and will likely begin strictly enforcing the rules. It is advised to collect a Form W-9 from all vendors so that 1099-NECs can be issued if needed. Form 1099-NEC Due Date Form 1099-NEC is due each year to the recipient and IRS by January 31st. The new accelerated deadline will help the IRS improve its efforts to spot errors on returns filed by taxpayers. For more information on form 1099-NEC and 1099-Misc visit the IRS website. Things to know right off the bat:

Tax deductions help lower how much of your income is subject to federal income taxes. While tax credits lower your actual tax bill dollar for dollar. These credits can be refundable or nonrefundable.

Retirement Plans - 401(k)s, IRAs and more:

Loan Forgiveness Rules Under the Paycheck Protection Program and Next Steps (Updated 6-5-2020)5/13/2020 Updated PPP Rules:

Here are six ways the law attempts to make using PPP loans easier:

Original Post: https://www.cpapracticeadvisor.com/tax-compliance/news/21137315/loan-forgiveness-under-the-paycheck-protection-program-and-next-steps The Coronavirus Aid, Relief, and Economic Security (CARES) Act established the Paycheck Protection Program (PPP) as an incentive for small businesses to retain employees during the COVID-19 pandemic. The program provides a low-interest loan to eligible small business owners, self-employed individuals, and other eligible businesses, including nonprofit organizations, and is meant to cover payroll, mortgage interest, rent, and utilities over an 24 week period. The maximum loan amount is 2.5 times the average monthly payroll from the previous calendar year and is capped at $10 million per business. The application period began on April 3, 2020, and runs through when all the funds have been committed. The loan carries a maturity of two years and a 1% interest rate.

The following expenses are included in loan forgiveness and the non-payroll items are capped at 40% of the loan proceeds:

Your clients’ allowable forgiveness is reduced for any decrease in the number of full-time equivalent (FTE) employees by comparing the average number of monthly FTE employees employed during the 24 week period after they receive your loan with either a) the average monthly FTE level for Feb. 15 through June 30, 2019, or b) Jan. 1 through Feb. 29, 2020. However, you won’t be penalized for any reduction occurring between Feb. 15, 2020, through April 26, 2020, if the reduction is eliminated by June 30, 2020.

Records your clients need to maintain: Number of employees on the payroll, employee pay rates and salary levels, payroll tax filings, and payroll costs paid in the 24 weeks after loan disbursement. Your clients will be asked to compare the average number of monthly FTE employees they employ during the 24 week period after they receive their loan with either a) the average monthly FTE level for Feb. 15 through June 30, 2019, or b) Jan. 1 through Feb. 29, 2020.

All of these expenses must be paid within 24 weeks from the date the funds hit your clients’ bank to qualify for forgiveness. At the end of those eight weeks, your client can apply for PPP loan forgiveness with their lender. It will be helpful to track this information on spreadsheets or through QuickBooks. Here are some tips if your clients use QuickBooks and its tracking features:

WHAT THE SBA SAYS ABOUT IT: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program#section-header-7 Do I have to pay tax on my stimulus payment?

No. The tax rebate is an advance payment of a special 2020 tax credit…so it is nontaxable. I owe back taxes. Will my rebate be reduced? No. IRS will not apply the stimulus payment to offset past-due taxes or other federal or state debt, except for delinquent child support owed by a person. My wife and I had a baby in Feb. Will we get an extra $500 tax rebate? Yes, assuming you otherwise qualify…but not this year. On your 2020 return, which you will file next year, you will reconcile the rebate money that you received with your actual tax situation. If you otherwise qualify for the tax rebate break, you get an extra $500 refundable credit for your newborn on your 2020 Form 1040. I just got my rebate. What if my 2020 AGI ends up being too high to qualify? Do I have to repay the money? No. Rebates generally don’t need to be repaid. For more on stimulus payments, see www.kiplinger.com/letterlinks/checks. It has answers to lots of queries and includes a description of two new IRS web tools: One is for people who would qualify for a stimulus payment but didn’t file a 1040 for 2018 or 2019 because their income was under the threshold amount to file a return. The other is for people to enter bank account information to get their rebates faster through direct deposit, and for individuals to check on the status of their payment. I took a required minimum distribution from my traditional IRA in Feb. Now that Congress has waived RMDs for 2020, can I put it back into the IRA? Yes, and it will be treated as a tax-free rollover, provided you return the funds to the IRA by July 15, and you don’t violate the one-rollover-every-12-months rule. Normally, you have 60 days to do a tax-free rollover, but IRS extended the time period for rollovers otherwise due between April 1 and May 15 of this year to July 15. If you took an RMD in Jan., you’re out of luck…at least for now. You can’t redeposit the funds back into the IRA and treat it as a tax-free rollover. But tax practitioners tell us they expect the Revenue Service to issue guidance on the new RMD waiver, and that those rules may provide broad rollover relief. My small business is applying for a Paycheck Protection Program loan. If my firm gets the loan and it is forgiven, is the canceled debt taxable? No. The stimulus law says that loan amounts forgiven under the PPP are nontaxable. Are unemployment benefits taxable? Yes, for federal income tax purposes. State taxation is a mixed bag. 33 states and D.C. fully tax the income. Ind. and Wis. tax them in part. Ala., Calif., Mont., N.J., Pa. and Va. don’t tax them. Alaska, Fla., Nev., N.H., S.D., Tenn., Texas, Wash. and Wyo. have no income tax. New Paying and Filing Deadline - July 15th

The IRS, OR and the City of Portland have moved the filing and paying deadline from April 15th until July 15th. This included paying, filing, HSA & IRA contributions, 1st Quarter Estimates (IRS only) and other deadlines. Oregon and City of Portland have NOT changed 1st quarter estimate, it is still April 15th. Not all states are following exactly in line with the IRS. Please click the link to find out who is and who isn't. April 15th - New Deadlines Unemployment, Self-Employed Relief & Portland Small Business Relief Fund The CARES act was signed into law on March 27, 2020 and will expand Unemployment Insurance benefits. Link In the near future, they will provide guidance to customers on the:

Economic Impact Payment Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child. Economic impact payments: What you need to know Employee Retention Credit IRS: Employee Retention Credit available for many businesses financially impacted by COVID-19 Link

Families First Coronavirus Response Act Treasury, IRS and Labor announce plan to implement Coronavirus-related paid leave for workers and tax credits for small and midsize businesses to swiftly recover the cost of providing Coronavirus-related leave Link

2. FAQs from the IRS: COVID-19-Related Tax Credits for Required Paid Leave Provided by Small and Midsize Businesses FAQs Link Employers See FAQ #6 on this page: Link

Assistance For Businesses The SBA can help! Link Two SBA emergency capital programs are available today and more will be coming soon:

Find your local SBA office here. Link Check IRS.gov for the latest information: No action needed by most people at this timeIR-2020-61, March 30, 2020

WASHINGTON — The Treasury Department and the Internal Revenue Service today announced that distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people. However, some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment. Who is eligible for the economic impact payment? Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child. How will the IRS know where to send my payment? The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible. For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed. The IRS does not have my direct deposit information. What can I do? In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail. I am not typically required to file a tax return. Can I still receive my payment? Yes. People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. How can I file the tax return needed to receive my economic impact payment? IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple, but necessary, information including their filing status, number of dependents and direct deposit bank account information. I have not filed my tax return for 2018 or 2019. Can I still receive an economic impact payment? Yes. The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return. I need to file a tax return. How long are the economic impact payments available? For those concerned about visiting a tax professional or local community organization in person to get help with a tax return, these economic impact payments will be available throughout the rest of 2020. Where can I get more information?The IRS will post all key information on IRS.gov/coronavirus as soon as it becomes available. The IRS has a reduced staff in many of its offices but remains committed to helping eligible individuals receive their payments expeditiously. Check for updated information on IRS.gov/coronavirus rather than calling IRS assistors who are helping process 2019 returns. Tax Day now July 15: Treasury, IRS extend filing deadline and federal tax payments regardless of amount owed:

IR-2020-58, March 21, 2020 WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020. https://www.irs.gov/newsroom/tax-day-now-july-15-treasury-irs-extend-filing-deadline-and-federal-tax-payments-regardless-of-amount-owed Oregon: Department of Revenue Announces Extension of Tax Filing Deadlines and Payments: March 25, 2020 Salem, OR—At the direction of Governor Kate Brown, the Oregon Department of Revenue today announced an extension for Oregon tax filing and payment deadlines for personal income taxes and some other taxes closely following the IRS extension declaration. https://www.oregon.gov/newsroom/Pages/NewsDetail.aspx?newsid=36265 SPECIAL NOTE: Oregon has decided NOT to extend 1st quarter estimated tax payments. 1st Quarter estimated tax payments are still due April 15th. City of Portland: Extended 2019 Filing & Paying Deadline: March 27, 2020 The Revenue Division is automatically extending the Portland and Multnomah County business tax return filing due on 4/15/2020 until 7/15/2020. https://www.portlandoregon.gov/revenue/44311 SPECIAL NOTE: City of Portland has decided NOT to extend 1st quarter estimated tax payments. 1st Quarter estimated tax payments are still due April 15th. Other States: Please check with your current state agency as there is not a uniform stance on waiving penalties and interest until July 15th. https://www.taxadmin.org/state-tax-agencies |

Our Mission“At MB we are tax professionals and business consultants. We are in partnership with you, year round, to lower your tax liability to the fullest extent of the law, maximize profits, inspire growth and provide peace of mind.” Archives

November 2023

|

Call 503-595-5890