|

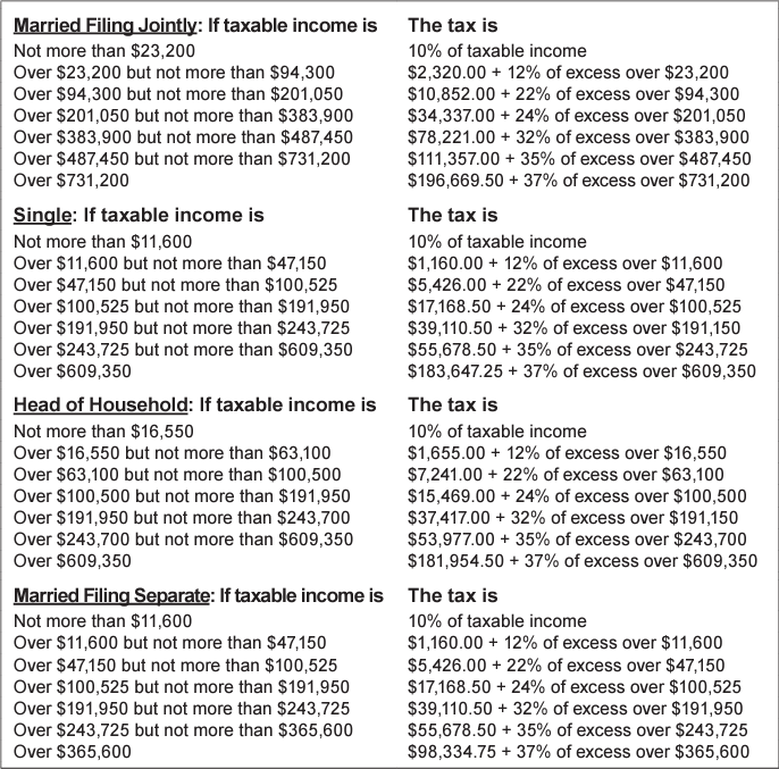

There are lots of tax changes for 2024. Some reflect prior-year inflation. Others are new rules. But one thing is certain…all taxpayers are affected. Start with key provisions in SECURE 2.0… the 2022 law to bolster retirement savings. It has over 90 provisions with different effective dates. Among the changes that take effect this year: More penalty-free early withdrawals by people under age 59½ from IRAs and 401(k)s. Up to $10,000 for domestic abuse victims and $1,000 for emergencies can be taken without paying the 10% additional tax. Funds in 529 education accounts can be rolled over tax-free to a Roth IRA. There is a $35,000 lifetime cap. Rollover amounts can’t exceed the annual payin limit for Roth IRAs. And the 529 account must have been open for more than 15 years. Roth 401(k) owners no longer need to take required minimum distributions. Plan sponsors can create emergency savings accounts for participants, who could then make Roth payins (on an after-tax basis) to that savings account within the plan. A participant’s account balance can’t exceed $2,500. The qualified charitable distribution cap is indexed for inflation, so that IRA owners 70½ and older can transfer up to $105,000 in 2024 from their IRAs directly to charity without having to pay tax on the withdrawal. Plus these: The employer contribution limits for SIMPLEs increase. Employers with no existing retirement plans can offer starter 401(k) accounts with default automatic enrollment (with a payin cap the same as that for IRAs). Additionally, student loan relief can be offered through workplace retirement plans. Key dollar limits on workplace retirement plans and IRAs increase for 2024. The maximum 401(k) contribution is $23,000. People born before 1975 can contribute an extra $7,500. These limits also apply to 403(b)s and 457 plans. SIMPLEs have a $16,000 cap, plus $3,500 for individuals age 50 and older. The 2024 contribution cap for traditional IRAs and Roth IRAs is $7,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and older. The income ceilings on Roth IRA payins are higher. Contributions phase out at AGIs of $230,000 to $240,000 for couples and $146,000 to $161,000 for singles. 2024 deduction phaseouts for traditional IRAs range from AGIs of $123,000 to $143,000 for couples covered by 401(k)s and $77,000 to $87,000 for singles and household heads. If only one spouse is covered by the plan, the phaseout range for deducting payins for the uncovered spouse is $230,000 to $240,000. The Social Security annual wage base for 2024 is $168,600, an $8,400 hike. The Social Security tax rate on employers and employees remains 6.2%. Both pay the 1.45% Medicare tax on all compensation, with no cap. Individuals also pay an additional 0.9% Medicare surtax on wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn’t hit employers. The nanny tax threshold is $2,700 for 2024, a $100 increase from 2023. The income tax brackets for individuals are much wider for 2024 because of inflation during the 2023 fiscal year. Tax rates are unchanged. Standard deductions are higher for 2024. Married couples get $29,200, plus $1,550 for each spouse 65 or older. Singles can claim $14,600…$16,550 if age 65 or up. Heads of household get $21,900 plus $1,950 once they reach 65. Blind people receive $1,550 more ($1,950 if unmarried and not a surviving spouse). Tax rates on long-term capital gains and qualified dividends do not change. But the income thresholds to qualify for the various rates go up for 2024. The 0% rate applies at taxable incomes up to $94,050 for joint filers, $63,000 for household heads and $47,025 for singles. The 20% rate starts at $583,751 for joint filers, $551,351 for household heads and $518,901 for single filers. The 15% rate is for filers with taxable incomes between the 0% and 20% break points. AMT exemptions rise for 2024 to $133,300 for couples and $85,700 for singles and household heads. The exemption phaseout zones start at $1,218,700 for couples and $609,350 for others. The 28% AMT rate kicks in above $232,600. The kiddie tax has less bite in 2024. The first $1,300 of unearned income of a child under age 19…under age 24 if a full-time student…is tax-free. The next $1,300 is taxed at the child’s rate. Any excess is taxed at the parent’s rate. Eligible buyers of qualifying EVs can opt to monetize the up to $7,500 credit, starting in 2024, by transferring it to the dealer at the time of purchase, thus lowering the amount the buyer pays for the car. Buyers can otherwise elect to claim the break on their federal tax return that they will file in the subsequent year. Guidance from the Service requires auto dealers to register on IRS’s online tool, IRS Energy Credits Online, to receive advance credit payments from eligible EV sales. Buyers who opt for the advance credit to lower the cost of the car will have to repay it when filing their 1040 if their modified AGI exceeds the limit for taking the credit. The adoption credit is taken on up to $16,810 of qualified expenses in 2024. The full credit is available for a special-needs adoption even if it costs less. The credit phases out for filers with modified AGIs over $252,150 and ends at $292,150. The annual cap on deductible contributions to HSAs rises in 2024 to $4,150 for account owners with self-only coverage and $8,300 for those with family coverage. People born before 1970 can put in an extra $1,000. Eligibility for HSAs is restricted. You must have a high-deductible health plan. The minimum policy deductible for 2024 is $1,600 for self-only coverage and $3,200 for family coverage. Additionally, out-of-pocket costs, including copayments, can’t exceed $8,050 for individual coverage and $16,100 for family coverage in 2024. Here are the limits on deducting long-term-care premiums for 2024. Taxpayers who are age 71 or older can write off as much as $5,880 per person. Filers age 61 to 70…$4,710. Those who are 51 to 60 can deduct up to $1,760. Individuals who are 41 to 50 can take $880. And people age 40 and younger…$470. For most, long-term-care premiums are medical expenses deductible only by itemizers on Schedule A and only to the extent that total medicals exceed 7.5% of AGI. Self-employed individuals can deduct the premiums on Schedule 1 of the 1040. Employees covered by health flexible savings accounts can defer up to $3,200. The cap on tax-free employer-provided parking for 2024 is $315 a month. The exclusion for mass transit passes and commuter vans matches that amount. U.S. taxpayers working abroad have a $126,500 income exclusion for 2024. The Revenue Service delays the lower dollar threshold for 1099-K reporting. A 2021 law requires third-party settlement networks, such as PayPal, Venmo and Square, to send 1099-Ks to payees who are paid more than $600 a year for goods and services. It was scheduled to begin with 2022 1099-K forms sent out in 2023. The rule got lots of slack, so IRS has now postponed it for the second year in a row. 2023 Forms 1099-K sent out this year will be covered by the old rules. Forms will be sent to payees with over 200 transactions, who were paid over $20,000. 2024 Forms 1099-K sent out in 2025 will have a $5,000 reporting threshold. If filing 10 or more information returns, they must be electronically filed. The previous 250-return threshold for e-filing has been drastically lowered, beginning with 2023 information returns filed this year. The e-filing requirement applies to 1099s, W-2s, 1098s and many other forms. All information returns are combined for purposes of meeting the 10-return threshold for e-filing. IRS has an online portal to e-file Forms 1099. Information Returns Intake System or IRIS is free for businesses of any size, but you’ll need an ID.me account to use it. Filers who can’t comply can use Form 8508 to apply for a hardship waiver. The lifetime estate and gift tax exemption for 2024 is $13,610,000… More estate tax liability qualifies for an installment payment tax break. If one or more closely held businesses make up greater than 35% of a 2024 estate, as much as $740,000 of tax can be deferred, and IRS will charge only 2% interest. The annual gift tax exclusion is $18,000 per donee. You can gift up to $18,000 ($36,000 if your spouse agrees) to each child, grandchild or any other person in 2024 without having to file a gift tax return or tap your lifetime estate and gift tax exemption. First-year bonus depreciation isn’t as valuable in 2024. Last year, businesses could deduct 80% of the cost of new and used qualifying business assets with lives of 20 years or less. This year, the 80% write-off decreases to 60%. But expensing is higher. $1,220,000 of assets can be expensed in 2024. This limit phases out dollar for dollar once more than $3,050,000 of assets are put into use in 2024. Note that the amount of business assets expensed can’t exceed the business’s taxable income. Bonus depreciation doesn’t have this rule. A key dollar threshold on the 20% deduction for pass-through income rises in 2024. Self-employeds and owners of LLCs, S corporations and other pass-throughs can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes of more than $383,900 for joint filers and $191,950 for all others. More companies can use the cash method of accounting. For taxable years beginning in 2024, C corporations with average annual gross receipts of $30 million or less over the previous three years can use the cash method. This threshold also applies to partnerships and LLCs that have C corporations as owners. The 2024 standard mileage rate for business driving is 67 cents per mile. The mileage allowance for medical travel and military moves is 21 cents per mile in 2024. The charitable driving rate is fixed by law and stays put at 14 cents a mile. Certain clean-energy credits in the Inflation Reduction Act can be monetized. Businesses may elect to transfer 11 of the credits to unrelated third parties for cash. State and local government and their instrumentalities and tax-exempt organizations can elect to treat 12 of the energy-savings credits as a payment of federal income tax and receive an income tax refund for the amount that exceeds any taxes they owe. A new beneficial ownership reporting regime for small firms begins in 2024. It’s run by the Financial Crimes Enforcement Network. Certain corporations, LLCs and other entities must report information about themselves and their beneficial owners to FinCEN. There are lots of exceptions to reporting, including one for operating firms with over 20 full-timers, over $5 million in gross receipts, and a U.S. physical office. Entities in existence before 2024 have until Dec. 31, 2024, to file their report. Entities formed after 2023 have 90 days after the date of formation to comply. Reporting will be done electronically through FinCEN’s website. Although this isn’t a tax rule, businesses and tax professionals should be aware of it. Credit to THE KIPLINGER TAX LETTER

0 Comments

Leave a Reply. |

Our Mission“At MB we are tax professionals and business consultants. We are in partnership with you, year round, to lower your tax liability to the fullest extent of the law, maximize profits, inspire growth and provide peace of mind.” Archives

November 2023

|

Call 503-595-5890